maryland student loan tax credit amount

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to. Under Maryland law the.

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

What is the Maryland Student Loan Debt Relief Tax Credit.

/1099g-b89de84cce054844bd168c32209412a0.jpg)

. An official website of the State of Maryland. Who wish to claim the Student Loan Debt Relief Tax Credit. February 18 2020 842 AM.

Complete the Student Loan Debt Relief Tax Credit application. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. Increasing from 5000 to 100000 the amount of the Student Loan Debt Relief Tax Credit that certain individuals with a certain amount of student loan debt may claim against the State.

This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. Marylands tax credit program for student loan debt relief has been in existence since 2017.

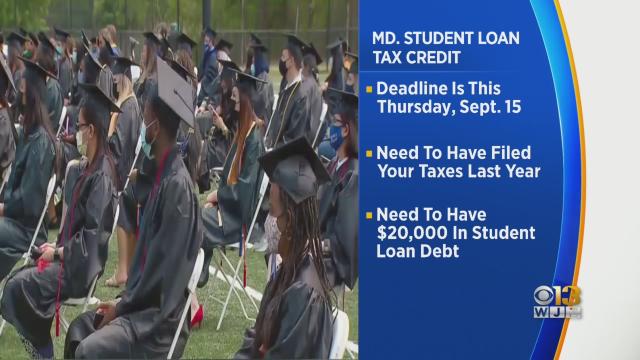

Otherwise recipients may have to repay the. To qualify for the tax credit applicants who attended a Maryland institution must have filed their state income taxes and have a student loan of at least 20000 while. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission.

Complete the Student Loan Debt. Student Loan Debt Relief Tax Credit. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission.

If the credit is more than the taxes you would otherwise owe you will receive a. 082522 Since 2017 Marylands student loan debt relief tax credit has provided over 40. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

Incurred at least 20000 in. Complete the Student Loan Debt Relief Tax Credit application. To qualify for the Student Loan Debt Relief Tax Credit you must.

Student Loan Debt Relief Tax Credit. The credits goal is to aid residents of the Chesapeake Bay state who took out college. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

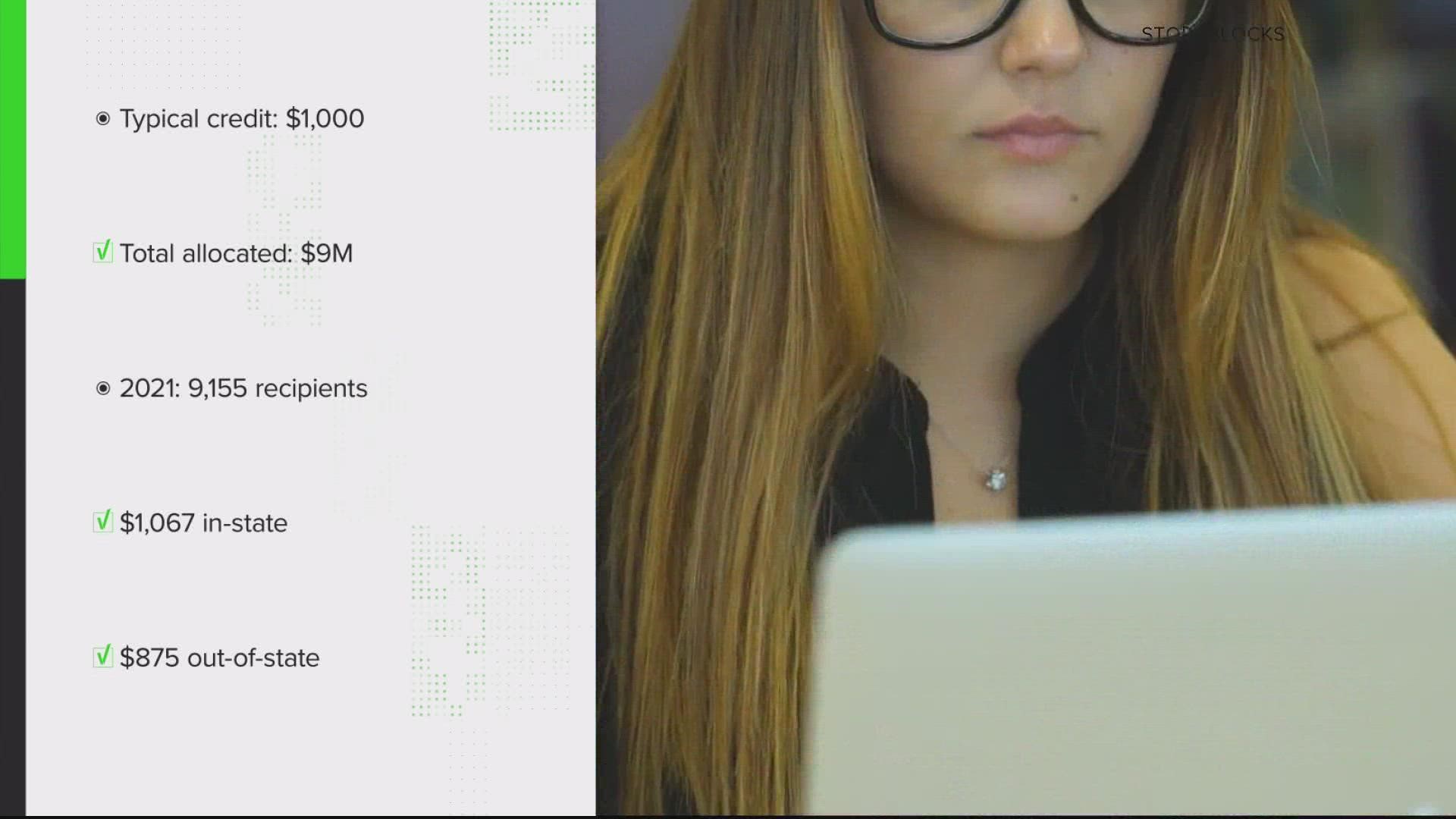

Selected recipients will be asked to prove that they used the full amount of the tax credit for the repayment of eligible student loans. To be eligible you must claim Maryland residency for the 2022 tax year file 2022 Maryland state income taxes have incurred at least 20000 in undergraduate andor graduate. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund.

Maryland taxpayers who maintain Maryland residency for the 2022 tax year. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code. The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by.

File Maryland State Income Taxes for the 2019 year. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to. The program offers an income tax credit to residents who make payments on.

Maryland Tax Credits Is Your Client Taking Advantage Of The Ones They Are Eligible For Youtube

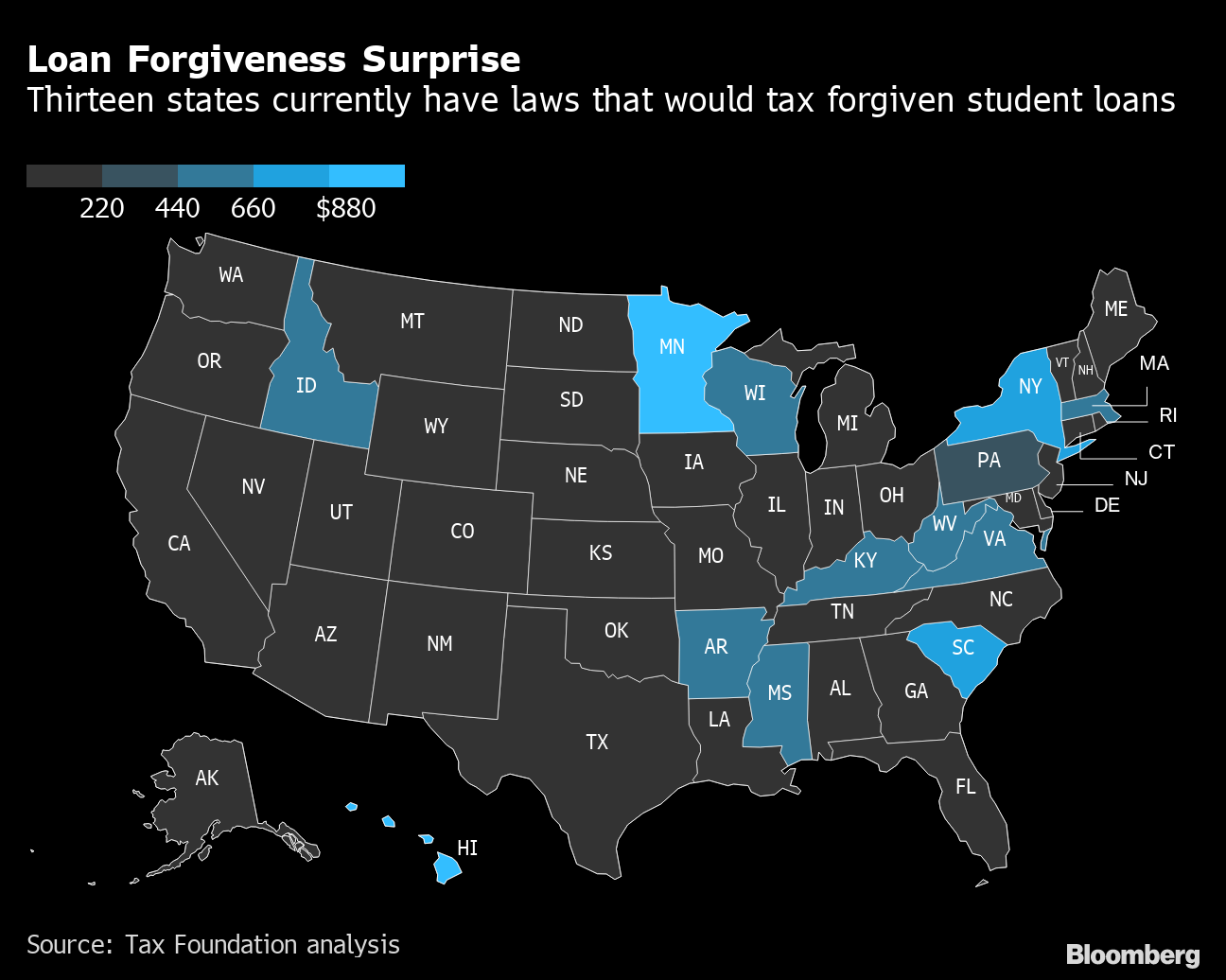

State Taxes And Student Loan Forgiveness Ibr Pslf And More

Maryland S 1 000 Student Debt Relief Tax Credit How To Apply Deadline

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

Maryland Student Loans Debt Statistics Student Loan Hero

Student Loan Forgiveness Is Taxed In These 13 States Bloomberg

Tax Credit 2022 Claim 1000 Student Loan

The Harbor Bank Of Maryland Review Black Owned Free Checking Account

Student Loan Forgiveness Statistics 2022 Pslf Data

Student Loan Forgiveness Is Taxed In These 13 States Bloomberg

Hogan Proposes Student Loan Interest Tax Credit Public College Tuition Cap The Washington Post

2022 Tax Credit The Deadline For Maryland Residents To Apply For Debt Relief On 1 000 In Student Loans Is In 18 Days Maryland News

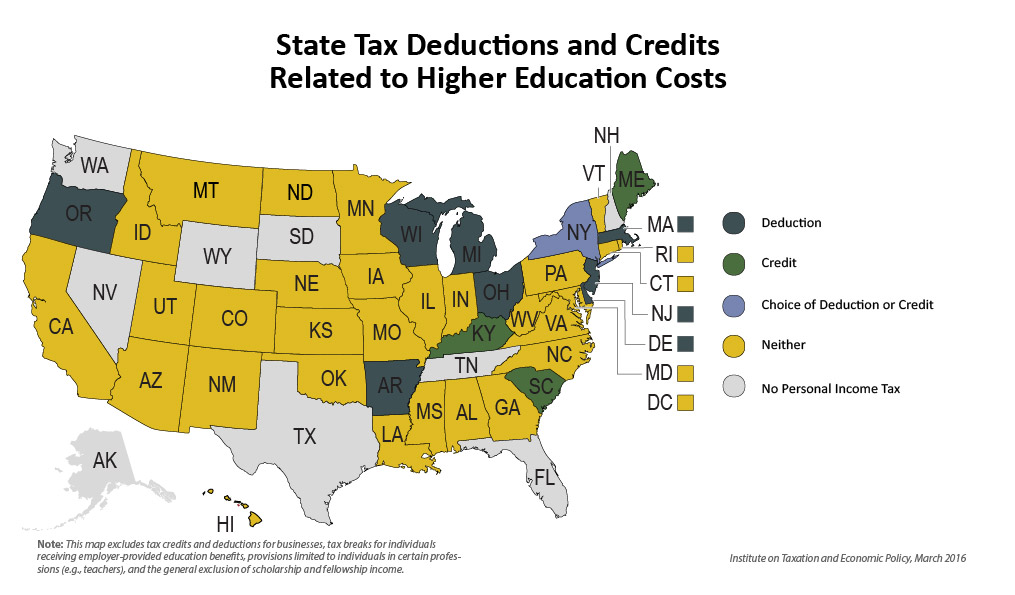

Higher Education Income Tax Deductions And Credits In The States Itep

States Step In Relieving The Burden Of Student Loan Debt Rockefeller Institute Of Government

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit

Maryland Paycheck Calculator Smartasset

Deadline Looms To Apply For Maryland Student Loan Debt Relief Tax Credit Wtop News

Your Income Is Too High For Student Loan Forgiveness Now What

What Is Maryland Student Loan Debt Relief Tax Credit Statanalytica